Capital market scenarios are used in many fields and sectors. Real-world expectations of capital markets are playing an increasingly important role in the crucial issue of corporate planning. General economic key figures also have a considerable influence on projections for corporate management. In modern simulation programs, such real-world scenarios are occasionally used stochastically, whereby the deterministic form is often used.

Another prime use of capital market scenarios is the valuation within risk-neutral models. This applies particularly to companies in the financial industry. The calculations and simulations to be created are predominantly stochastic. For insurance companies, there is a need to create a market value-oriented (economic) view in addition to the German GAAP-oriented, deterministic reporting. This can have an impact on the investment universe, including targeted financial market products. Consequently, institutional investors are affected with regard to making appropriate strategic asset and risk allocation decisions.

Based on the stochastic simulation methods used for the analysis, scattered results that depend on the postulated interest rate structure follow. Particularly in life and health insurance, but also in the long-tail business of property / casualty insurance, this can have significant consequences for risk and capital management. The interaction of investment income and actuarial practice produces increases in fluctuations in the results, especially those of the solvency capital.

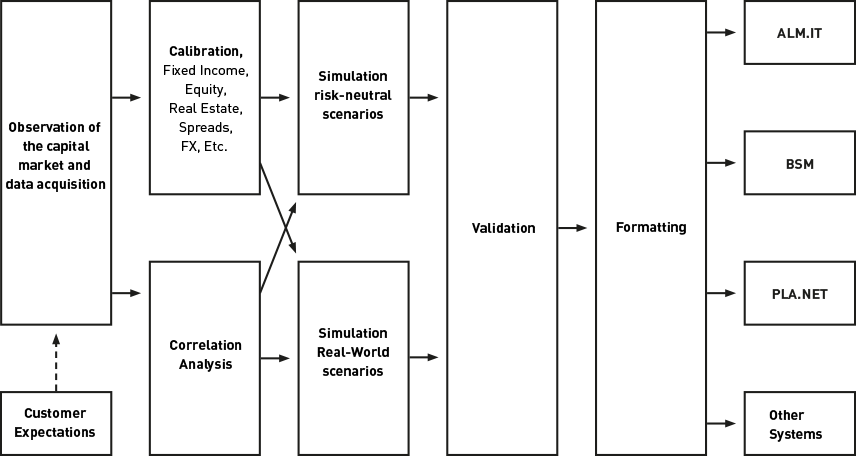

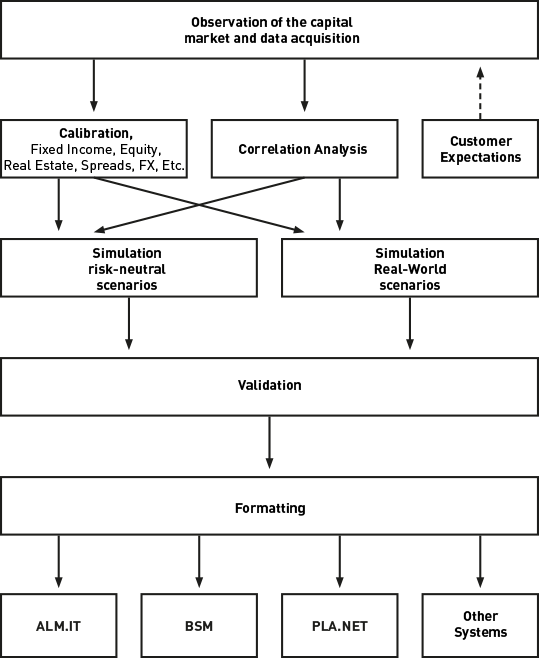

To be able to correctly evaluate asymmetries and key risk figures, the respective parameters must be determined with as many yield developments as possible. The best possible depiction of the investment is required for this purpose. Interest rate structures alone are not enough. Risk factors such as stock indices, real estate performance and credit spreads, as well as other economic factors affecting the claims area, including feedback across the causal network (correlation and causality), need to be simulated.

Our established procedure has been certified by a leading auditing firm to guarantee our clients greater audit security in their use of Solvency II reporting. Because the generation of capital market scenarios containing several thousand paths is very computationally intensive, ROKOCO Predictive Analytics offers the option of producing capital market scenarios on a company’s behalf.

Scenarios for the following purposes can be ordered:

- risk-neutral valuation (e.g. for Solvency II)

- real-world valuation (e.g. for planning)

- PRIIP calculations

In this case, the produced scenarios can be conveniently and easily retrieved via a file server for use in the company. This saves the client tedious tasks, such as the search for suitable simulation seeds or carrying out the complex validation process. In addition to the scenario files provided, supplementary documentation, such as detailed validation reports, method documentation, etc. are also included.

We support our clients with these services:

- validation

- calibration

- simulation

- training on ESG-processes