PLA.NET is a standard software package for your asset liability management for life, health and property / casualty insurances. A broad range of questions can be addressed by PLA.NET in the areas of asset management, controlling, risk management, accounting and actuarial operations.

The functionalities of the two industry-specific ALM systms, ALM.IT and SERA, have been transferred to PLA.NET for property / casualty insurers.

Scope of Service and Areas of Application of PLA.NET

- Evaluation and optimization of asset allocation

- Assessment of long-term strategies and derivatives hedging

- Assessment of new asset classes

- Execution of ALM analyses in line with the Bulletin 4/2011

- Determination of measures of risk in connection with risk management

- Solvency II, self-analysis and management

- Solvency II, generation of selected input data for the industry simulation model (for example, cash flows)

- Liquidity planning

- Market Consistent Embedded Value

- International Financial Reporting Standards (IFRS) – quantitative data preparation and analyses

- Product development: the influence of new products on the solvency capital

- Evaluation and optimization of the reinsurance structures in property / casualty insurance

- Ability to answer actuarial questions in areas such as: assessment of long-term guarantees, costs of the additional interest reserve (ZZR) (life insurance), reduction of actuarial interest due to the AUZ (health insurance) and development of the loss reserves (property / casualty insurance)

PLA.NET results are the stochastic development of the capital investments, the income statement, the balance sheet, the RfB and numerous other key figures. These other key figures include, for example, net and market value return, AUZ, solvability ratio, cost ratios, combined ratio, earnings indicators for the profit test, ROE, IRR etc.

These valuations not only follow the HGB (German GAAP), but are also carried out from an economical perspective.

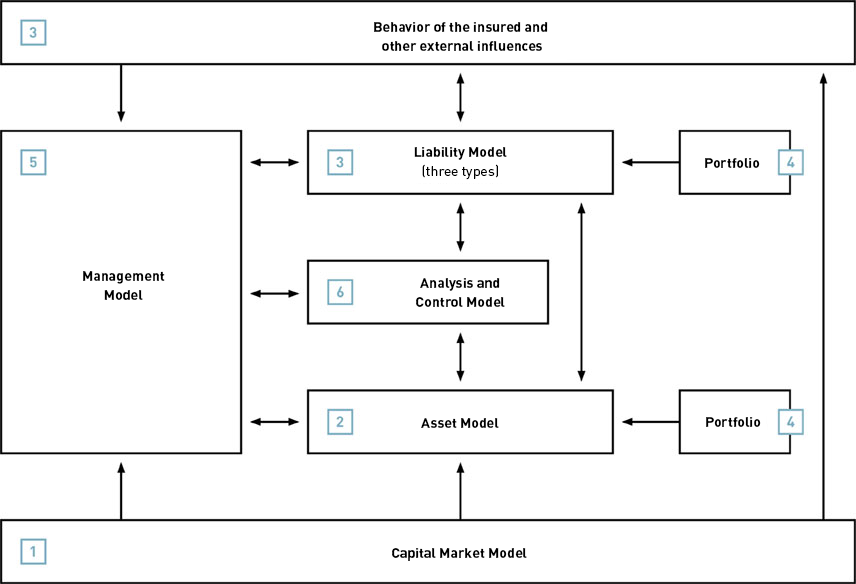

Capital Market Model

Capital Market Model

Asset Model

Asset Model

Liability Model

Liability Model

Compression

Compression

Management Model

Management Model

Analyses

Analyses